Thanks to research and innovation, our knowledge of cancer is fast-evolving and so are the drugs to treat it.

Even in the last decade, many more cancer drugs have become available compared to what we’ve seen in previous decades. They’re also becoming more advanced and more expensive. And they’re being assessed earlier, sometimes before their overall ability to extend or improve patients’ lives has been fully determined.

While this has led to more cancer treatment options, it has also led to more uncertainty about drugs’ clinical benefit and cost-effectiveness. But new approaches to using real-world evidence in the NHS can play a role in addressing this.

What’s value for money?

In the UK, the Medicines and Healthcare products Regulatory Agency (MHRA) licenses new drugs. The National Institute for Health and Care Excellence (NICE) assesses whether licensed drugs should be offered to NHS patients in England. Based on estimates of the drug’s cost-effectiveness, NICE determines if it’s value for money at the price negotiated between the NHS and the manufacturer. This is no easy feat, especially considering how cancer drugs are evolving.

Firstly, cancer drugs are becoming more complex, sometimes with a high upfront cost but with benefits that can only properly be observed in the longer term, such as with CAR T-cell therapies.

This means the full picture of a drug’s cost-effectiveness is not always clear at the time the assessment is made.

Secondly, cancer drugs are becoming more expensive. In 2020, oncology accounted for 15% of the total drug spending across 11 major countries, up from 3% in 1995. And while the NHS and pharmaceutical industry have agreed measures to control NHS drug spending, and the UK pays relatively low prices compared to other countries, increasing prices can prove unsustainable and make long-term cost-effectiveness estimates challenging.

Thirdly, cancer drugs are being assessed earlier, partly because some promising cancer drugs are fast-tracked through the regulatory approval process.

While that’s certainly positive, it has raised questions about medicines’ effectiveness in later studies or in patients in the real world compared to clinical trials – especially in the US, where the Food and Drug Administration (FDA) (the US drugs regulator) frequently uses fast-track approvals.

And research has found that, in recent years, more drug licence submissions to US and EU regulators use non-randomised study designs. While there can be many good reasons why randomised controlled trials aren’t feasible for some drugs, the lack of randomisation can add to the uncertainty.

So how do the NHS and NICE balance the need to get promising new drugs to patients quickly with the need for certainty that they are cost-effective?

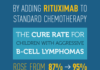

Real-world evidence has proven successful.

The reformed Cancer Drugs Fund (CDF) funds certain promising cancer drugs on a temporary basis and thereby ensures they’re available to patients in the NHS in England quicker. During this period, the manufacturer is expected to address the initial uncertainty, either by conducting more clinical trials or collecting real-world data on the drug’s effectiveness in the NHS. This data then informs a new assessment of the drugs’ cost-effectiveness and sometimes new price negotiations between the NHS and the manufacturer.

But the process of regulatory approval and cost-effectiveness assessment is evolving further.

The UK’s post-Brexit initiatives

After Brexit, the UK Government is exploring new ways of getting cancer drugs to patients quicker while addressing some of the inherent cost-effectiveness uncertainty.

Post-Brexit regulatory reform is part of the UK Government’s agenda of making the UK a life sciences superpower, and the UK regulator MHRA is taking steps to work more closely with the FDA and speed up the regulatory process.

But will this lead to more uncertainty about drugs’ effectiveness after approval like we’ve seen in the US? It’s too early to say.

For example, the new Innovative Licensing and Access Pathway (ILAP) aims to accelerate the time to market and facilitate patient access to innovative drugs by engaging developers at the pre-clinical trial stage and improving the whole assessment pathway.

The MHRA has also joined Project Orbis, an international programme coordinated by the US FDA to review and approve promising cancer drugs.

If these trends and initiatives continue to facilitate earlier assessment, new and innovative thinking may be needed.

Linking prices to treatment success

At Cancer Research UK, we think flexible drug pricing mechanisms can help address some of cancer drugs’ increasing cost-effectiveness uncertainty.

Working with the Greater Manchester Health and Social Care Partnership, we’re exploring linking the price the NHS pays for a drug to how well individual patients respond to the treatment – so called outcome-based payments (OBP).

And the potential benefits are big. This approach may improve and speed up patient access to some new cancer drugs and ensure the NHS only pays for outcomes that are actually achieved for individual patients. Currently, the NHS negotiates a price with the drug’s manufacturer which is fixed regardless of patients’ treatment outcomes.

And instead of funding a drug while more data is collected to inform a new cost-effectiveness assessment and a fixed price – as the CDF does – OBP would dynamically adjust the price of a drug based on how well it works for individual patients.

So far, we’ve found through our research that patients value four core outcomes when going through cancer treatment: survival, disease progression, long-term side effects, and returning to normal activities.

But OBP comes with a range of challenges.

To collect data on these core outcomes, hospitals need data infrastructure improvements and staff need more time and capacity. All of which need to be considered before implementing it in the NHS.

While OBP by no means replaces the rigorous regulatory approval process and NICE’s cost-effectiveness assessment, it may be useful in situations where data from completed clinical trials or the CDF is unlikely to address uncertainty.

At Cancer Research UK, we hope to further develop our understanding of OBP and its implications. We also encourage the pharmaceutical industry, the NHS and other decision-makers to continue to explore this approach for the potential benefit of people with cancer in the future.